403 B Max Contribution 2024 Over 55

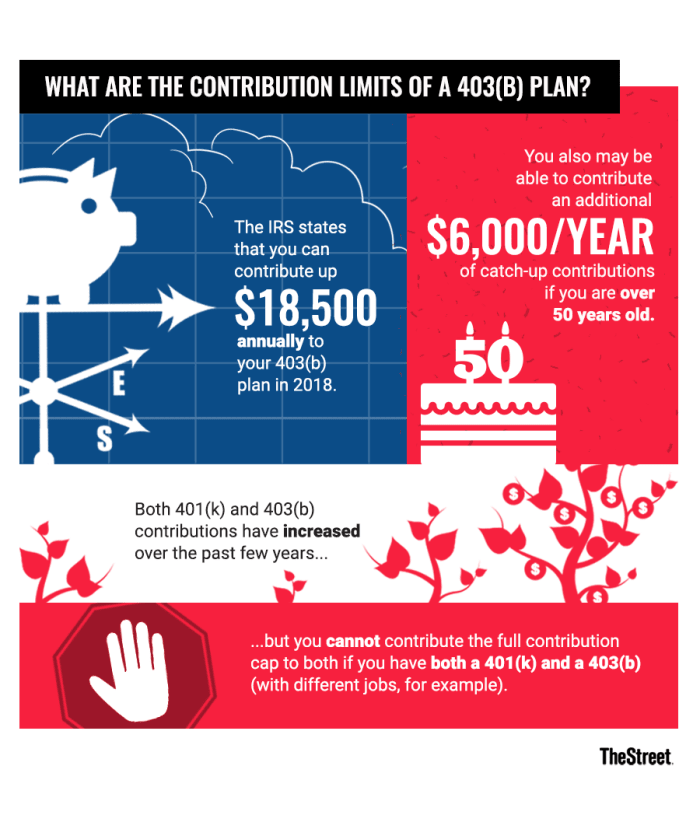

403 B Max Contribution 2024 Over 55. 403(b) contribution limits in 2024 and 2023 for 2024, employees under 50 can contribute up to $23,000. No contribution is too small, and it can amount to more than you might think over time.

However, if you are at least 50 years old or older, you. 2024 401(k)/403(b)/401(a) total contribution limit the total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000.

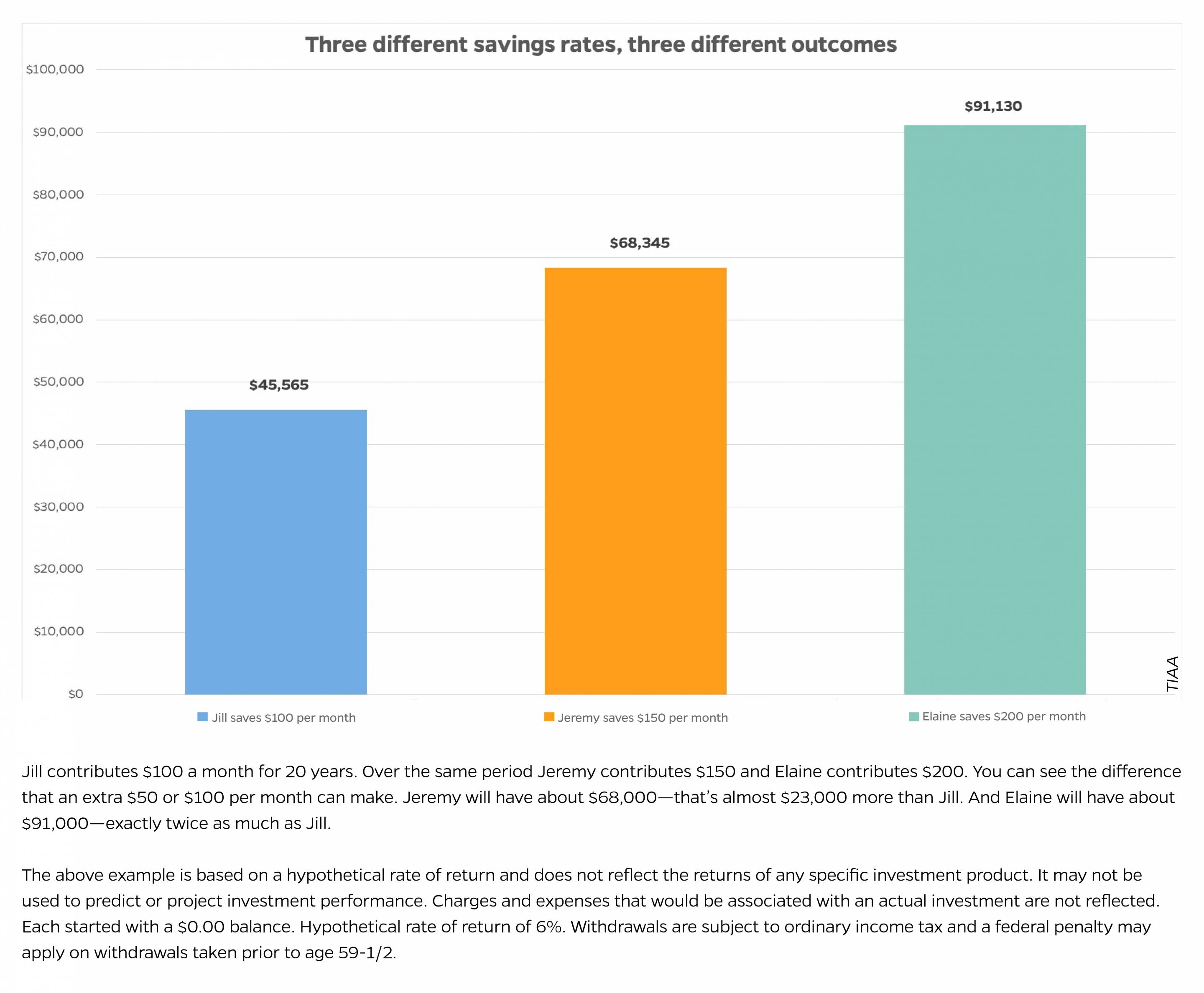

No Contribution Is Too Small, And It Can Amount To More Than You Might Think Over Time.

403(b) max contribution is flexible.

Contribution Limits For 403(B)S And Other Retirement Plans Can Change From Year To Year And Are Adjusted For Inflation.

If you are under age 50, the annual contribution limit is $23,000.

403 B Max Contribution 2024 Over 55 Images References :

Source: zorinawshawn.pages.dev

Source: zorinawshawn.pages.dev

403 Max Contribution 2024 Rosie Claretta, Simple ira the simple ira contribution limit increased by $500 for 2024 and workers at small businesses can contribute up to $16,000 or $19,500 if 50 or over. 401 (k) contribution limits for 2024.

Source: www.thestreet.com

Source: www.thestreet.com

What Is a 403(b) Plan and How Do You Contribute? TheStreet, 403(b) max contribution for 2024. Maximum 401k contribution 2024 over 55.

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

Max 403b Contribution 2024 Jeanne Maudie, 2024 401(k)/403(b)/401(a) total contribution limit the total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000. Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

Source: www.financestrategists.com

Source: www.financestrategists.com

Maximum 403(b) Contribution Limits, Factors, and Strategies, Maximum 401k contribution 2024 over. Maximum contribution limit for 403(b) plans elective deferral limit.

Source: stevenawetti.pages.dev

Source: stevenawetti.pages.dev

403 Contribution 2024 Karon Maryann, The irs sets a limit on the total contributions, including both elective deferrals and employer. The contribution limit for individuals engaged in 401(k), 403(b), and the majority of 457 plans, along with the federal government’s thrift savings plan, has been.

:max_bytes(150000):strip_icc()/403bplan_final-67070c84b22b42478c5bb4c12792995c.png) Source: www.investopedia.com

Source: www.investopedia.com

What Is a 403(b) TaxSheltered Annuity Plan?, 403(b) max contribution is flexible. Learn about the contribution limits for 403(b) retirement plans in 2024.

Source: hub.jhu.edu

Source: hub.jhu.edu

Making voluntary contributions to your 403(b) retirement plan Hub, Maximum contribution limit for 403(b) plans elective deferral limit. 2024 401(k)/403(b)/401(a) total contribution limit the total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000.

Source: daniqmyrtice.pages.dev

Source: daniqmyrtice.pages.dev

403b Max Contribution 2024 With Catch Up Gerry Juditha, This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403(b) plan for. Maximum 401k contribution 2024 over.

Source: www.thetechedvocate.org

Source: www.thetechedvocate.org

Understanding the 403(b) Retirement Plan The Tech Edvocate, 2024 401(k)/403(b)/401(a) total contribution limit the total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000. The irs sets a limit on the total contributions, including both elective deferrals and employer.

Source: www.pinterest.com

Source: www.pinterest.com

2021 403(b) and 457(b) Max Contribution Limits Remain Unchanged, The 401k/403b/457/tsp contribution limit is $22,500 in 2023. In 2024, this limit stands at.

If You Are Under Age 50, The Annual Contribution Limit Is $23,000.

What is the 401k 2024 limit for over 50 ynez analise, for 2024, the 401 (k) contribution.

Learn About The Contribution Limits For 403(B) Retirement Plans In 2024.

Meaning the portion of salary that an employee decides to put directly into the 403(b) account.

Posted in 2024