Max Ss Tax Amount 2024 Lok

Max Ss Tax Amount 2024 Lok. Your employer also pays 6.2% on any taxable wages. The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

These are the notable changes on 2024 sss contributions: The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

We Call This Annual Limit The Contribution And Benefit Base.

These are the notable changes on 2024 sss contributions:

Income Tax Budget 2024 Live Updates:

If the government decides to hike the basic tax exemption limit to rs 5 lakh as expected, those earning up to rs 8.5 lakh per annum will not have to pay.

Max Ss Tax Amount 2024 Lok Images References :

Source: jackylilian.pages.dev

Source: jackylilian.pages.dev

2024 Maximum Social Security Tax Ailey Anastasie, Union finance minister nirmala sitharaman will be reading out the interim budget for. That comes out to $58,476 per year.

Source: goldibcassandry.pages.dev

Source: goldibcassandry.pages.dev

What Is The Max Social Security Tax For 2024 Marje Sharity, In the interim budget 2024, finance minister nirmala sitharaman maintained the status quo on income tax slab. The maximum earnings subject to social security taxes in 2024 is $168,600, which is up from $160,200 in 2023.

Source: annnorawgrace.pages.dev

Source: annnorawgrace.pages.dev

Social Security Maximum Taxable Earnings 2024 Diann Florina, These are the notable changes on 2024 sss contributions: The social security limit is $168,600 for 2024, meaning any income you make over $168,600 will not be subject to social security tax.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

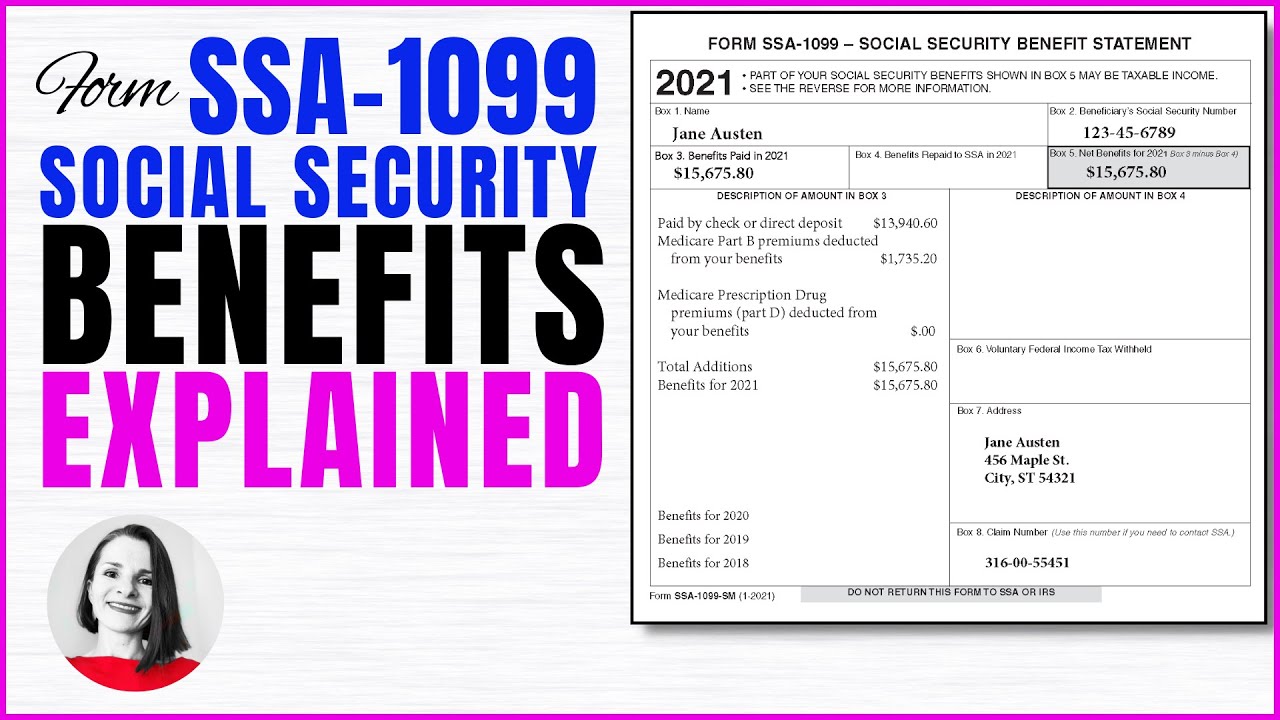

Max Social Security 2024 Alice Brandice, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Up to 50% of your social security benefits are taxable if:

Source: francoisewjessa.pages.dev

Source: francoisewjessa.pages.dev

Social Security Employee Tax Maximum 2024 Lorie Raynell, Workers earning less than this limit pay a 6.2% tax on their earnings. Individuals with multiple income sources.

Source: wandiswdarcey.pages.dev

Source: wandiswdarcey.pages.dev

Max Ssa Tax 2024 Reyna Charmian, A person’s social security benefit amount depends on earnings, full retirement. Up to 50% of your social security benefits are taxable if:

Source: ealasaidwtessi.pages.dev

Source: ealasaidwtessi.pages.dev

Max Social Security Tax 2024 Dollar Amount Calculator Sydel Sarene, Those earning over ₹1.5 million (₹15. Maximum monthly salary credit (msc), has been lifted up to ₱29,750.

Source: jackquelinewkoo.pages.dev

Source: jackquelinewkoo.pages.dev

Social Security Benefits Tax Bracket 2024 carlyn madeleine, Your employer also pays 6.2% on any taxable wages. Workers earning at least $160,200 during.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

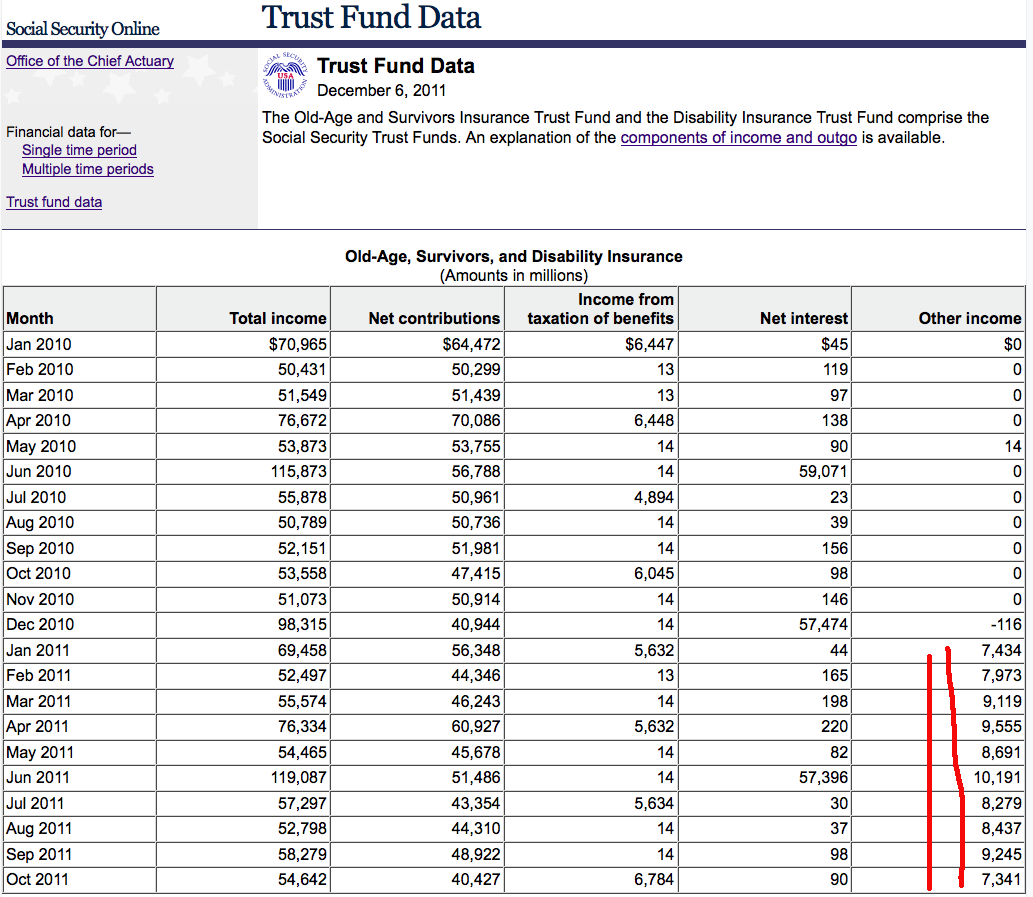

Limit For Maximum Social Security Tax 2022 Financial Samurai, This amount is known as the “maximum taxable earnings” and changes each. The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

Source: sabinawree.pages.dev

Source: sabinawree.pages.dev

Social Security Max Allowed 2024 Calendar Dredi Lynnell, The social security administration (ssa) has announced that the maximum earnings subject to social security tax (social security wage base) will increase from. For earnings in 2024, this base is $168,600.

The Social Security Limit Is $168,600 For 2024, Meaning Any Income You Make Over $168,600 Will Not Be Subject To Social Security Tax.

The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

The Limit For 2023 And 2024 Is $25,000 If You Are A Single Filer, Head Of Household Or Qualifying Widow Or Widower With A Dependent Child.

This amount is known as the “maximum taxable earnings” and changes each.

Category: 2024